Is there someone at IFSO or ISPO I can speak with regarding my taxes?

Neither UC San Diego nor any of its employees is authorized to offer tax advice, but we may be able to steer you to appropriate resources if you submit your question to internationaltaxhelp@ucsd.edu. For support in completing your tax filings, please use the resources on this website. GLACIER Tax Prep also has a HELP link accessible within GTP when you are completing your federal tax form. If you have additional questions regarding your specific situation, we recommend contacting the Internal Revenue Service (IRS) at (800) 829-1040. You may also contact the California Franchise Tax Board (FTB) for questions about state taxes at (800) 852-5711. You may also visit this helpful link from the IRS.

I did not earn any income last year. Am I still required to file taxes?

All nonresident aliens for federal tax purposes who are present in the U.S. in F, J, M, or Q statuses at any point in the tax year are required to file a Form 8843. Form 8843 is not an income tax return but an informational statement required by the U.S. government.

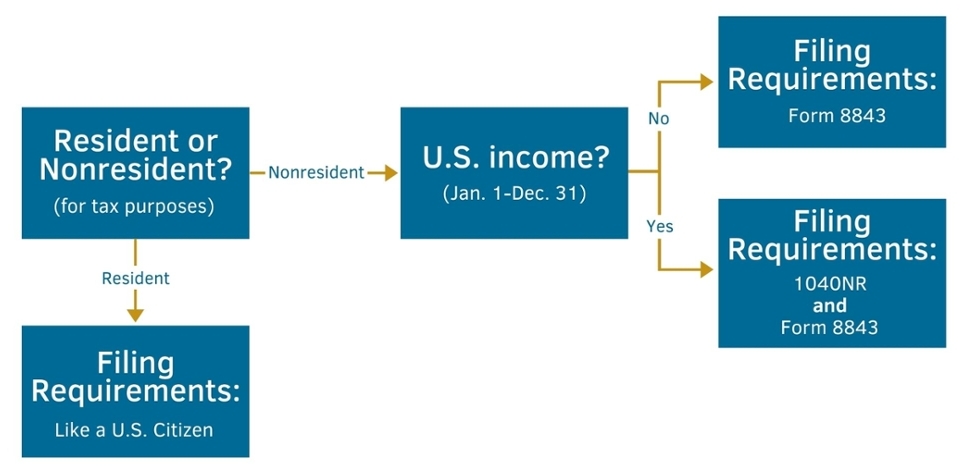

How do I determine if I am a resident or nonresident?

If you created a Glacier record during the previous tax year it will have identified you as a Resident or Nonresident alien for tax purposes. You may also take the Substantial Presence Test to make this determination, making sure to not count days as an exempt individual (F-1/J-1 student or J-1 scholar). You can also refer to Publication 519, “U.S. Tax Guide for Aliens” for more information. For California state tax residency determination, refer to Publication 1031.

Where can I get my tax return filing forms?

If you use GLACIER Tax Prep, it will help prepare the form 1040NR and Form 8843. Tax forms can also be found at the Internal Revenue Service or the California Franchise Tax Board.

I need an ITIN (Individual Taxpayer Identification Number) to claim a tax treaty benefit for myself or a dependent. What should I do?

If GLACIER Tax Prep indicates that you or a dependent will require an ITIN in order to receive a tax benefit, you may apply for an ITIN at the local San Diego IRS office (see their information on the ITIN process).

I received a 1099INT or 1042-S from my bank. What should I do?

Nonresident aliens for federal tax purposes in J/F status are not taxed on interest from simple bank accounts; you may wish to file an IRS form

W-8 BEN with your bank to avoid receiving these documents/having tax withheld.

I received a 1098-T. What should I do?

Nonresident aliens for federal tax purposes are not eligible for tax credits based on tuition payments; you do not need to do anything with this form. Resident aliens for federal tax purposes may be eligible for tax credits.

I used TurboTax to file last year's return when I am a Nonresident Alien for federal tax purposes. What should I do?

You will need to file an amended federal

1040X return; you may wish to consult with a Certified Public Accountant.

I received HEERF funding; is this taxable?

HEERF funding is not taxable.

My access to GTP through Glacier is greyed out. Why?

GTP is only available for nonresident 1040NR returns; it will not be accessible to persons it has determined are resident aliens for federal tax purposes.

I missed the April 15th deadline. What should I do?

You are still required to file; see

Form 4868 on requesting an extension. Please note that the form for filing an extension must be received by the regular due date of the return (April 15) and that payment, if any, is still owed by the due date and subject to interest/penalties if not paid. See

extension for state tax filing.

To properly file your tax returns, you need important tax documents from your school, your employer (if you have one), and your bank. If needed make sure you have all the following documents. If you do not have what you need, follow the directions below each document listed.

1099-Int

Form 1099-INT lists the amount of interest you earned from the bank for the tax year. Bank interest generally is not taxable for nonresident aliens for tax purposes. If needed, request a copy directly from your bank.

W-2

Your employer issued a Form W-2 in January of the current year stating wages earned as an employee during the prior tax year. If the University of California, San Diego was your employer and you did not receive your W-2, please see "Tax Resources" at top of this webpage. If your employer was NOT UC San Diego then you must contact your employer directly. Note that the state of California does not recognize tax treaties; thus, UC San Diego state earnings will be reported to you on a Form W-2, even if you are taking federal tax treaty benefits.

1042-S

Form 1042-S reports wage/salary payments exempt from federal withholding due to a tax treaty, regardless of tax residency status, fellowship payments to nonresident aliens, and other non-wage income paid to nonresident aliens such as Grad Student Stipend (Fellowship) payments, Surf fellowship payments, Postdoc fellowship payments, or taxable postdoc benefits.

1095-A, -B, or -C

These are a series of Health Care information Forms for Individuals relevant to the Affordable Care Act. The information in these forms will help you understand whether or not you may be required to make an "individual shared responsibility payment" (see more information). Nonresident aliens for tax purposes are not subject to Affordable Care Act requirements. For more information, see the IRS Questions and Answers.

1098-T

UC San Diego issues Form 1098-T to identify the amounts of tuition and fees paid on a student’s behalf during the tax year. Internationals are NOT required to have a 1098-T and nonresident aliens can derive no tax benefits based on tuition paid. Nonetheless, it can help establish how much money you spent on tuition and fees.

If you did not get a Form 1098-T from UC San Diego and you would like one, you can print one by following the instructions on https://www.ucop.edu/1098t/. Familiarize yourself with the web site. Be sure to click on the left hand column menu item called “User Instructions.” Click on the item called “Access My Record.” If you prefer, you may also call (877) 467-3821 to request that a Form 1098-T be mailed to you.

Calendar Year: Internationals in the U.S. for even only one day between January 1 and December 31 of any given year are considered to be in the U.S. for a “calendar year.” Example: internationals arriving in the U.S. on December 30 for U.S. tax purposes were in the U.S. for one calendar year, even though they were only in the U.S. for two days of the calendar year.

Compensation: This is any payment made in exchange for services performed. Payment might include cash, reduced tuition or rent, partial board, or other method of payment. Among other categories, compensation can be earned by anyone who is an employee, an intern, or a contractor.

Deduction or Exemption: This is an amount of money you may be permitted to deduct from your total taxable income when calculating how much tax you must pay.

FICA Tax: Also known as the “Social Security tax,” FICA is the composite of a retirement pension and medical benefits tax on employers and employees. The current FICA tax rate is 15.3%: the employer pays 7.65% and the employee pays 7.65%.

Foreign-Source Income: Income from sources outside the U.S. For nonresident aliens for federal tax purposes, this income type is not taxable; only U.S.-source income is taxable. See Publication 519, Table 2-1 to determine whether income is foreign- or U.S.-source. Note that the California Franchise Tax Board sources income based on where the work is performed rather than location of the payor; thus, work performed in California paid by a foreign employer is "California Source income."

Form 1040NR: Nonresident aliens for federal tax purposes are required to use this form if they have any U.S. source income.

Form 1042-S: Form issued to researchers, teachers, and students to report amounts exempt from tax under an income tax treaty or fellowship income. These amounts reflect income earned from scholarships, fellowships, grants, or compensation for personal services.

Form 1095-A, -B, or -C: Health Care information Forms for Individuals relevant to the Affordable Care Act (ACA). Nonresident Aliens for tax purposes do not need to meet ACA requirements, whereas resident aliens for tax purposes must. California has its own mandate for health insurance coverage.

Form 1098-T: Official statement from an institution of higher education documenting how much was paid on a student’s behalf for tuition and fees.

Form 10999-DIV: Financial institution statement indicating the amount of dividends, capital gains, etc., earned

Form 1099-INT: Bank statement listing the amount of interest earned

Form 1099-MISC: statement listing amount paid to an independent contractor for services performed

Form 8833: Official document used to claim tax treaty benefits

Form 8843: All IRS-defined nonresident aliens for tax purposes must complete this form. It declares that—

- An international is exempt from having to take the substantial presence test, or

- An international falls below the minimum number of days needed to establish substantial presence.

In either case, without substantial presence, an international must file tax documents as a nonresident alien for tax purposes. Form 8843 does NOT declare exemption from having to file tax returns or pay taxes. (See IRS Publication 519 for details.)

Form I-94: Arrival/Departure record (previously paper card stapled into passports; now mostly automated). The date indicated on this form is the date on which authorization to stay in the U.S. expires. Most internationals in F-1 or J-1 statuses have “D/S” indicated rather than a specific end date. “D/S” means “duration of status” or that stay in the U.S. is authorized indefinitely if the international continues to comply with U.S. immigration law relevant to the F or J category.

Form W-2: Issued by employers in January of the current year stating the amount of wages earned during the prior tax year and the amount of federal and state tax withholding.

Form W-4: Employees complete this form upon accepting employment to tell employers how much tax to withhold. Unlike U.S. citizens and permanent residents, internationals filing as nonresident aliens must follow special rules for completing Form W‑4.

Form W‑8BEN: Notifies U.S. institutions that persons are IRS-defined nonresident aliens, or that they are claiming U.S. tax treaty benefits on scholarships, fellowships, and other types of income.

Grant: Used to describe fellowships or scholarships. An amount to support study, training, or research, but does not represent compensation for any required service (such as teaching or research).

I‑94 Status: This is the nonimmigrant classification indicated on the Form I‑94 (it usually but not always echoes the classification of the visa stamp used to enter the U.S.). This is “your status”—e.g., F‑1, J‑1, etc.

Interest Income: Interest from a bank account or certain other US sources (for details, see IRS Publication 519: U.S. Tax Guide for Aliens). Bank interest is not taxable for nonresident aliens for federal tax purposes, and IRS-defined nonresident aliens should not report it.

Internal Revenue Service (IRS): The U.S. federal government authority charged with enforcing tax laws.

Itemized Deductions: If you file the 1040NR, you may list specific expenses within the guidelines of IRS Publication 519 and deduct these expenses from your taxable income.

Medicare Deductions: A significant part of what is known as the FICA tax. Medicare Deductions are imposed on wages and salaries and credited to a combination of a retirement pension and medical benefits. The current FICA rate is 15.3%: the employer pays 7.65% and the employee pays 7.65%. Those F-1 and J-1 persons filing as nonresident aliens do not have to pay Medicare Deductions.

Original Date of Entry: This is the first date you arrived in the U.S.—just before beginning your education or appointment. It is not the date that you last entered the U.S. after returning from a vacation or other trip.

Nonresident Alien: U.S. tax residency status of non-US citizens temporarily in the U.S. F‑1 Students and J‑1 Exchange Visitors are usually nonresident aliens when they first arrive in the U.S. H-1B Specialty Workers may be nonresident aliens, but usually only for their first year and if they entered the U.S. toward the end of the calendar year. Unlike US citizens and resident aliens, who are required to pay taxes on their worldwide income, nonresident aliens are required to pay taxes only on income from US sources. In addition, if a tax treaty exists between the nonresident alien’s home country and the USA, all or a portion of US-source income may be exempt from taxes. (See Publication 901: U.S. Tax Treaties.)

Permanent Resident Alien: This is a lawful permanent resident, also known as a “green-card holder.” This is an individual who has been accorded the privilege of residing permanently in the U.S. These persons are taxed in the same manner as US citizens—on worldwide income.

Resident Alien: An alien who is either a lawful permanent resident, an H-1B or O-1 holder, or an F-1 or J-1 holder who has spent enough time in the U.S. to pass the substantial presence test (see below). Resident aliens are taxed in the same manner as U.S. citizens—on income worldwide.

Social Security Deductions: Part of what is known as the FICA tax, Social Security Deductions are imposed on wages and salaries and credited to a combination of a retirement pension and medical benefits. The current FICA rate is 15.3%: the employer pays 7.65% and the employee pays 7.65%. Nonresident aliens in F-1 and J-1 status do not have to pay Social Security Deductions.

Substantial Presence Test: Determines “IRS residency status” (not the same as I‑94 status) for tax purposes. It calculates the number of days that an individual has been in the U.S. and determines whether that person is a “resident alien” or a “nonresident alien.” Internationals in F-1 or J-1 status are exempt from having to take the Substantial Presence Test—

- For students, for the first five calendar years, and

- For scholars, for the first two calendar years within a "look-back" period of six years

This exemption deems them to be nonresident aliens for the tax year in question. To claim this exemption, students and scholars must file Form 8843.

Tax Return: An official statement filed with the IRS to report taxable income during a calendar year. All internationals in the U.S. who have taxable income must file tax returns—a version of the 1040. Form 8843 alone is NOT a tax return.

Tax Year: For almost all internationals, this is the period of time from January 1 through December 31.

U.S.-Source Income: Income from sources within the U.S. For nonresident aliens for federal tax purposes, this type of income is taxable (as opposed to “foreign-source income,” which is not); see Publication 519. The state of California sources income based upon where the work is performed, rather than geographic location of payor; "Foreign Source" income may not be taxable to the federal government, but may be considered California Source Income and taxable to the state government.

U.S. Department of Homeland Security (“DHS”): The U.S. government entity that is charged with administering and enforcing U.S. laws concerning internationals, including laws and regulations governing F-1 and J-1 statuses.

U.S. Tax Residency Status: Non-U.S. citizens’ tax liability depends on this. All non-U.S. citizens are classified as either “resident aliens” or “nonresident aliens.” U.S. Tax Residency Status is independent of I‑94 status.

Withholding: Employers withhold a percentage of each paycheck and pay an estimated tax liability to the IRS, state, and local authorities. In this way, employees are not stuck with a very large tax bill to pay by April 15. In many cases, estimated tax liability is too high, and employees must file a tax return to get a refund of the money owed to them.